Reflections: CapitalRise Prime Property Insight – Summer 2019

Reflections: CapitalRise Prime Property Insight – Summer 2019

The UK still remains intrinsically wedded to Brussels, with hopes and promises of a smooth exit anything but proven. We have our third prime minister in just over three years; and will we ever be able get comfortable with President Donald J Trump and the macro uncertainty that he creates across the globe? It all makes for interesting, (if not at times repetitive) reading.

What, however, has and does this mean for the prime property market and CapitalRise?

At CapitalRise we have had a tremendous first half of the year, facilitating the funding of schemes in both London and the Home Counties, staying true to our mandate, and delivering both in terms of new loan origination and more importantly seeing loans repaid in a timely fashion.

In this edition of Reflections, we take a closer look at a few of the projects we have underwritten and the market commentary supporting our experience in prime property, which has led to us assessing over £1.88 billion pounds of deals in the first six months of 2019, only a select number of which have made it onto our platform as investment opportunities.

We are well positioned to provide a valuable perspective into the sector for our network of investors, borrowers and developers and in turn, highlighting why niche is important and the fundamentals of our success as CapitalRise, the lender built by developers.

Prime Central London

When the rest of the lending market have all but stopped lending to Prime Central London (‘PCL’) developments, and the press continue to write scare-mongering headlines of house prices falling in London, how is CapitalRise comfortable lending to developers in this location?

The answer lies in reading beyond the headlines. For the most part, on a generic basis, the headlines are correct and we would be wrong to pretend otherwise. However, beyond the headlines there are many positive undercurrents:

- Savills recently stated that ‘By the end of the first quarter of 2019 the values of the most expensive properties in London’s most prestigious postcodes had adjusted by -21.3% since their peak in 2014.’[View source]

- While not the most optimistic, if we look into the detail further, Chestertons Research states, ‘The Chestertons index which tracks prices in the high value locations, saw prices drop by just 0.3% in the first three months of 2019, compared to a fall of 1.2% recorded in the previous quarter. In the year to end-March, prices fell by 4.8% compared to a 5.2% drop at the corresponding point in 2018.’[View source] We therefore believe this is sound evidence that despite the ongoing uncertainty, the PCL market is beginning to find its level.

- Chestertons further states that ‘Despite the sense of frustration at the inability of politicians to bring Brexit negotiations to a conclusion, we are seeing pent-up demand in the higher value locations being released this year as buyers are no longer prepared to put their plans on hold. The shortage of available properties is limiting sales but we are seeing higher offers this year in many locations. If these trends continue this will filter through into higher sale prices, although any increases are likely to be minimal and will be felt in those locations where availability is lowest. Once Brexit is behind us, however, there is potential for a stronger bounce back as more pent-up demand is released.’[View source]

- This buyer demand is statistically demonstrated in Figure 1 (below) by a rise in ‘Applicants’ registrations and viewings, with Chestertons reporting double digit increases in these figures versus the same period in 2018. These buyers believe the market is at the bottom and now is the “right moment”. This is supported by what CapitalRise is seeing, with Q2 lending requests for development loans exceeding Q1, in terms of both quantity and value. Meanwhile sellers, who have been incurring holding costs and loans approaching expiry, are facing a greater urgency to sell and have become more realistic with their asking prices.[View source] Sales statistics show average discount-to-asking price spread contracting by 59 basis points in April versus March.[View source]

- We believe another factor is the multinational nature of buyers in this market. Prime property remains attractive to liquid international buyers who hold long term views on London retaining its status as a world city and safe haven. The weakening of sterling against major currencies has improved this attractiveness, particularly for those purchasing in US dollars, who benefit from PCL property worth almost 40% less than its 2014 peak (Figure 2, below).[View source]

- So far this year, CapitalRise has lent against property developments in Holland Park; Eaton Place; Drayton Gardens. As supported by the commentary above, these great addresses will always be sought after locations of national and international high net worth individuals seeking their own piece of London. However, we are not being unrealistic in relation to external market factors, which is reflected in our maximum loan-to-value ratio for any of these deals being 62% – which we believe is sufficiently conservative to weather uncertain times.

The Home Counties

Outside of Prime Central London, there are pockets across southern England still performing well. CapitalRise continues to fund developments in the Home Counties and outer suburbs, and we have valuable insight into the drivers of their performance.

Prime outer London has several fundamental pull factors which influence the demand and subsequent success of developments and investments. These factors include the quality of schools, the convenience of commute and the quality of the environment. These are considered during our due diligence process in addition to the financial budget, realistic timescales and the quality of the completed build:

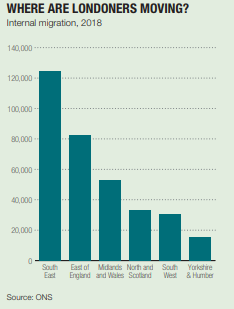

- Data from the Office for National Statistics (ONS) shows that the number of Londoners moving from the capital to other parts of England and Wales reached its highest ever level in 2018. The South East was the most popular region, followed by the East of England (Figure 3).

- The demographic of those purchasing in these areas tend to have young families and a high-quality nearby school adds significant value when determining location. UK wide, Ofsted schools that were rated ‘outstanding’ were priced 16% higher, on average, than a school rated ‘good’.[View source]

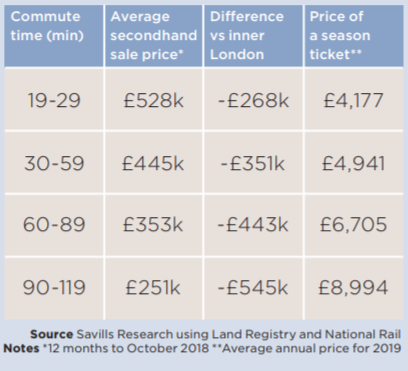

- Manageable commuting times are a significant influence, as three-quarters of those who relocate from London to the prime suburbs and commuter belt continue to work in the capital.[View source] Buyers, seeking to upgrade or purchase their first home, are also seeing greater value in purchasing outside of London, but within a manageable commute.

- Strutt & Parker highlight the value of the commute in their ‘Commuter’s Guide to Buying a Home’ Report, Q1 2019, in which they highlight High Wycombe as the most reliable train commute.[View source] The area is also mentioned in the ‘On Time Trains’ analysis of London commuter towns to find the fastest, most frequent services.[View source] This supports CapitalRise’s advance for a development a short walk from High Wycombe railway station.

- Those properties within 30 to 60 minutes commute to the capital cost less than prime properties in inner London. This has led to the increase in demand in outer prime London, which is leading the recovery, with April sales volumes up 14% from the same time last year.[View source]

- The surrounding environment and lifestyle on offer is also a determining factor in forecasting demand within a suburb. This could include the quality of retail, the history or architectural significance. In addition, market towns, and more rural areas with idyllic green settings, remain in high demand. For this reason, areas such as Beaconsfield, where CapitalRise have recently facilitated the funding of a development, are appreciating up to 2.5 times faster than the counties they are within.[View source]

- Where outer suburbs have all three factors, the effect is multiplied. A great example of this is Oxford, where CapitalRise has an upcoming funding opportunity, which has had an average price rise of 6.7% for the past 5 years.[View source]

- According to Knight Frank Research, the market for homes up to £1m has been less affected by political uncertainty, with values up by 2% since the referendum in June 2016. Above £2m, however, the Knight Frank Research index states that average prices are nearly 5% lower across the board than where they were at the time of the EU referendum, and still on average 20% below where they were at the peak of the market in 2008. Reflective of this, CapitalRise’s risk appetite in the Home Counties, (in terms of loan-to-value) is marginally higher for sub £1m properties, than those over that marker.

Outlook

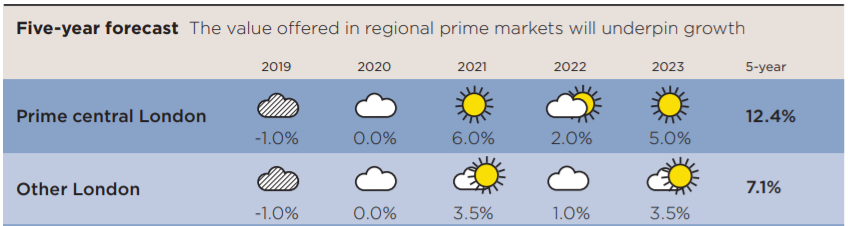

Valuers’ outlook is positive, with Savills forecasting prices increasing 12.4% over the next 5 years for PCL.[View source] CapitalRise have the same market outlook, which is why we are increasingly funding well-resourced developers and investors who are making opportunistic investments and looking to capitalise on the forecast upswing post-Brexit. This is evidenced by our recent loans to property in Chelsea & Belgravia. We remain well positioned with funds, expertise & lending criteria to fund a higher volume of property developments, sales period & short-term loans in PCL & the Home Counties.

Summary

So as the mercury in the thermometer has finally awoken for summer 2019, the strength of the sun is certainly providing positivity in those areas with proven resilience. As such, at CapitalRise we remain more confident than ever, that maintaining a continued high level of assessment and an educated lending approach is what will make the difference.

CapitalRise investors fund professional property developers. Our investments offer potential returns of 8-12% p.a. Find out more about our previous opportunities.

IMPORTANT INFORMATION

The information and opinions provided in this blog post is for general informative purposes only and is not intended to provide specific advice or recommendations for any individual or any specific investment opportunity.

Capital is at risk & interest payments are not guaranteed. Investments on our platform are illiquid and investors should consider these as long term investments. Investments are not directly into property. Investors are issued bonds by dedicated subsidiary property companies. Past performance and forecasts are not reliable indicators of future performance. There is no recognised market to sell this investment. Tax rules and allowances are dependent on individual circumstances and may change in the future. We recommend you seek advice from an appropriately qualified independent professional. See key risks before investing. Investment performance is not covered by the Financial Services Compensation Scheme.

Sources:

Chestertons, London Residential Report Spring 2019

Cushman & Wakefield, Residential Market Commentary, May 2019

Savills, Market in Minutes: Super Prime London

Savills Research, Fundamentals: Too much to ask?

Savills, Residential Property Forecasts

Office for National Statistics

The Commuter’s Guide to Buying a Home – the ten best places for a smooth commute to London