Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 mins to learn more.

Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 mins to learn more.

Track record

From launch in 2016 up to January 2026

Investing in property

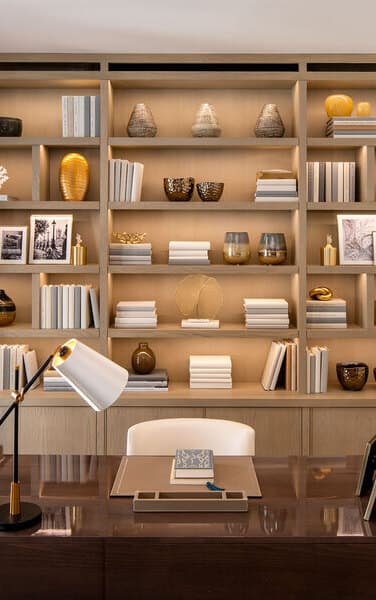

Quality

Access investments into loans funding prime property development in the finest locations

Accessible

Our minimum investment amount is just £1,000.

Rewarding

Investors collectively fund loans to property developers who pay interest on the loan.

Investing with CapitalRise

As with all investments your capital is at risk.

We'll send you regular updates throughout your investment.

At the end of the term you can have your money, plus returns, paid back to you or choose your next investment.

View all our opportunites and find the right investment for you.

Previous Opportunities

Tax-free returns

Utilise your £20,000 annual tax-free ISA allowance with a CapitalRise Innovative Finance ISA.

Benefits of an IFISA

We invest alongside you

Our founders invest their own personal funds in every single CapitalRise project

We would only be investing in a deal we fundamentally believe in

Uma Rajah, Co-founder & CEO

Testimonials

As seen in

Award winning

Best Alternative

Finance Provider

Best Alternative

Finance Provider

Best Business

Finance Provider

Residential Financier of

the Year

Specialist Lender of the Year

Development Lender of the Year

Proud members of the UK Crowdfunding Association

The UK Crowdfunding Association is an alliance that promotes the interests of crowdfunding platforms, their investors, and clients. Having created a unified voice for the industry, the UKCFA successfully cooperates with regulators and lawmakers to help the industry progress and bring positive change to the UK’s financial sector.

Want to become a member?

Apply now - become an eligible investor

Do your due diligence to understand the risks

Choose from a range of opportunities and start investing.