Refurbishment Finance: Unlocking Value in Prime Real Estate

Refurbishment is one of the most powerful tools in a developer’s arsenal – and in 2025, bridging finance is playing a pivotal role in unlocking its potential.

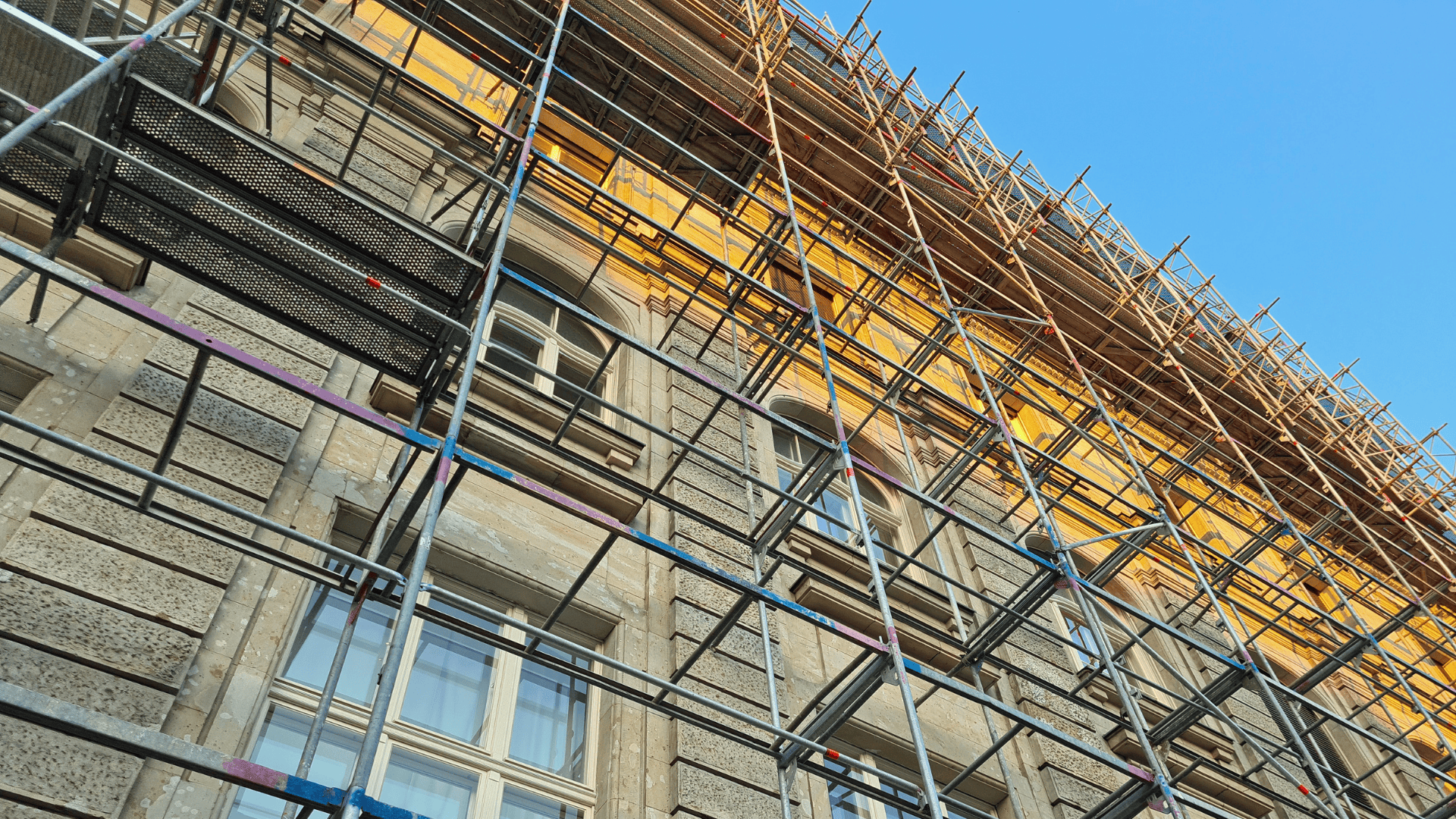

From light cosmetic upgrades to full-scale structural transformations, refurbishment projects are thriving across the UK’s residential and mixed-use markets. Whether it’s enhancing EPC ratings, converting commercial units, or repositioning high-end assets, developers are using bridging finance to move quickly and add value.

At CapitalRise, we’re seeing strong demand for refurbishment funding. Recent deals include a £6.3m acquisition bridge to support the refurbishment and repositioning of Gloucester hotel. We’ve also funded the restoration and extension of a three-storey, semi-detached period home in Clapham Common, and supported an extensive upgrade of a four-storey house in Westbourne Grove, Notting Hill — including the excavation of a new basement featuring a gym, cinema, children’s playroom, and steam room. Each of these bespoke projects highlights the agility and precision that bridging finance can deliver.

Why is refurbishment so attractive right now? For one, it allows developers to maximise returns without the complexities of ground-up development. Furthermore, in a market where planning can be slow and unpredictable, refurb projects can potentially offer faster turnaround and lower risk.

Bridging finance is uniquely suited to support these ambitions. Its speed enables developers to act on opportunities, while its flexibility allows for tailored drawdowns and repayment structures. At CapitalRise, we work closely with borrowers to understand the scope of works, timelines, and exit strategy – ensuring the finance fits the project, not the other way around.

As the prime market continues to evolve, we believe refurbishment will remain a key driver of growth and innovation. With the right finance partner, borrowers can unlock exceptional value quickly, confidently, and commercially.